Introduction

How small businesses create invoices has a direct impact on payment speed, cash-flow stability, and long-term professional credibility. Many business owners focus heavily on sales and service delivery while treating invoicing as a routine administrative task. This mistake often leads to delayed payments, disputes with clients, and disorganized financial records.

An invoice is not just a request for money. It is a formal business document that records a transaction, explains what was delivered, shows how charges were calculated, and clearly states when payment is due. When invoices are vague or inconsistent, clients may delay payment simply because the expectations are unclear.

Small businesses that use structured invoicing systems usually experience fewer disputes, faster payments, and better financial control. Invoices also act as reliable records for bookkeeping, audits, and future planning.

This guide explains how small businesses create invoices step by step, even without accounting experience. You’ll learn what information invoices must include, how calculations work, real-world invoicing examples, common mistakes to avoid, and how online tools can simplify the entire process.

Why Proper Invoicing Is Important for Small Businesses

Invoices are the foundation of financial communication between a business and its clients. They document transactions and define payment expectations in a clear, professional way. Invoices are widely recognized as formal transaction records in basic accounting and business practices.

Proper invoicing helps small businesses:

- Track income accurately over time

- Reduce payment delays and follow-ups

- Avoid disputes caused by unclear charges

- Maintain organized financial records

- Support accounting and financial reporting

Without consistent invoices, businesses often lose track of outstanding payments. Informal billing methods such as messages, emails without structure, or handwritten notes may work initially but quickly become unreliable as the business grows.

Professional invoices also improve trust. Clients are far more likely to respect payment deadlines when invoices are clear, detailed, and professionally formatted.

How Small Businesses Create Invoices Step by Step

Step 1: Add Business and Client Information

Every invoice must clearly identify both parties involved in the transaction.

Include:

- Business name

- Business address (if applicable)

- Contact details (email or phone)

- Client name

- Client address or company name

This information ensures the invoice is recognizable and legitimate. Even freelancers and sole proprietors benefit from consistent business details, as it reassures clients that the invoice is authentic.

Step 2: Assign a Unique Invoice Number

Invoice numbers are essential for tracking and organization. Each invoice should have a unique reference number.

Best practices include:

- Using sequential invoice numbers

- Avoiding duplicate numbers

- Keeping a consistent numbering format

Invoice numbers help businesses track unpaid invoices, reference documents during communication, and organize records efficiently.

Step 3: Include the Invoice Date and Due Date

Invoices must clearly show:

- Invoice issue date

- Payment due date

Avoid vague phrases like “pay soon” or “due ASAP.” Instead, use clear deadlines such as:

- Payment due within 14 days

- Payment due by 30 June 2025

Clear due dates reduce confusion and improve payment timelines.

Step 4: List Products or Services Clearly

The most important part of an invoice is the itemized list of products or services.

For each line item, include:

- A clear description

- Quantity or hours worked

- Rate or unit price

Example:

- Website maintenance services – 6 hours × $50

Clear descriptions reduce disputes and show transparency.

Step 5: Calculate the Subtotal Accurately

The subtotal is the total amount before taxes or discounts.

To calculate:

- Multiply quantity by rate for each item

- Add all line-item totals

Incorrect subtotals are one of the most common invoicing mistakes and often delay payments.

Step 6: Apply Taxes and Discounts (If Applicable)

If your business charges tax:

- Display the tax rate

- Show the calculated tax amount

If discounts apply:

- Clearly mention the discount

- Apply it after the subtotal

Transparent calculations help clients understand how the final amount was determined.

Step 7: Highlight the Total Amount Due

The total amount due should be visually clear and easy to find.

Ensure:

- The currency is specified

- The total stands out

- No hidden charges appear

Clients should immediately know how much they owe.

Step 8: Add Payment Terms and Instructions

Invoices should explain how payment should be made.

Include:

- Accepted payment methods

- Payment deadline

- Late payment terms (if any)

Clear payment instructions reduce delays and unnecessary follow-up questions.

Step 9: Review the Invoice Before Sending

Before sending an invoice, review it carefully.

Check:

- Calculations

- Client details

- Formatting consistency

- Payment deadline accuracy

Sending incorrect invoices damages credibility and delays payment.

Real-World Invoice Examples for Small Businesses

Understanding theory is useful, but real-world examples show how small businesses create invoices in practical situations.

Freelancer example:

A freelance designer bills 10 hours at $40 per hour. The invoice includes hours worked, rate, subtotal, and payment deadline. Clear descriptions prevent disputes about time spent.

Service business example:

A cleaning company bills a monthly service package. The invoice lists services provided, frequency, and total cost, helping the client understand recurring charges.

Online seller example:

An online seller invoices for physical products. The invoice includes item names, quantities, unit prices, shipping charges, and total amount due.

In all cases, clarity and structure prevent misunderstandings and speed up payments.

How Professional Invoicing Improves Cash Flow

Invoices are directly linked to cash flow. Clear invoices reduce delays by eliminating confusion and unnecessary back-and-forth communication.

When invoices include itemized charges, clear due dates, and payment instructions, clients know exactly what is expected. This reduces excuses for late payments.

Consistent invoicing also improves predictability. Businesses can forecast income more accurately and plan expenses with greater confidence.

How Invoices Affect Business Reputation and Client Trust

Invoices are often one of the few formal documents clients receive from a business. Poorly structured invoices can damage first impressions, even if the service quality is high.

Professional invoices:

- Build client confidence

- Demonstrate organization

- Signal reliability

- Strengthen long-term relationships

Clients are more likely to work repeatedly with businesses that communicate clearly and professionally. Over time, invoicing becomes part of your brand reputation.

How Invoice Clarity Reduces Payment Disputes

One of the biggest reasons small businesses face payment disputes is unclear invoicing. When an invoice lacks detailed descriptions, accurate calculations, or clearly stated payment terms, clients may question charges or delay payment while seeking clarification.

Clear invoices reduce disputes by showing exactly what was delivered, how prices were calculated, and when payment is due. Itemized services, transparent tax calculations, and visible totals eliminate guesswork for clients. When everything is documented, disagreements become rare and easier to resolve.

Invoice clarity also protects businesses legally and financially. In case of misunderstandings, a detailed invoice serves as written proof of agreed charges. Small businesses that prioritize invoice clarity spend less time arguing over payments and more time focusing on growth and customer service.

Who Benefits Most from Structured Invoicing

Structured invoicing benefits many types of small businesses.

Freelancers use invoices to document billable hours and avoid disputes.

Service-based businesses rely on detailed invoices to justify charges.

Consultants depend on professional invoices to maintain credibility.

Online sellers use invoices to track sales and provide transparency.

Understanding how small businesses create invoices properly allows all these groups to operate more efficiently.

How Often Small Businesses Should Review Their Invoicing Process

Invoicing should not remain static. Small businesses should regularly review their invoicing process as they grow.

Review invoicing when:

- Pricing changes

- New services are added

- Payment terms evolve

- Client volume increases

Periodic reviews help ensure invoices remain accurate, professional, and aligned with business goals.

Common Invoice Mistakes Small Businesses Should Avoid

Many payment delays come from avoidable errors, including:

- Missing invoice numbers

- Incorrect totals

- Vague descriptions

- No payment due date

- Inconsistent formatting

Avoiding these mistakes improves payment speed and reduces administrative workload.

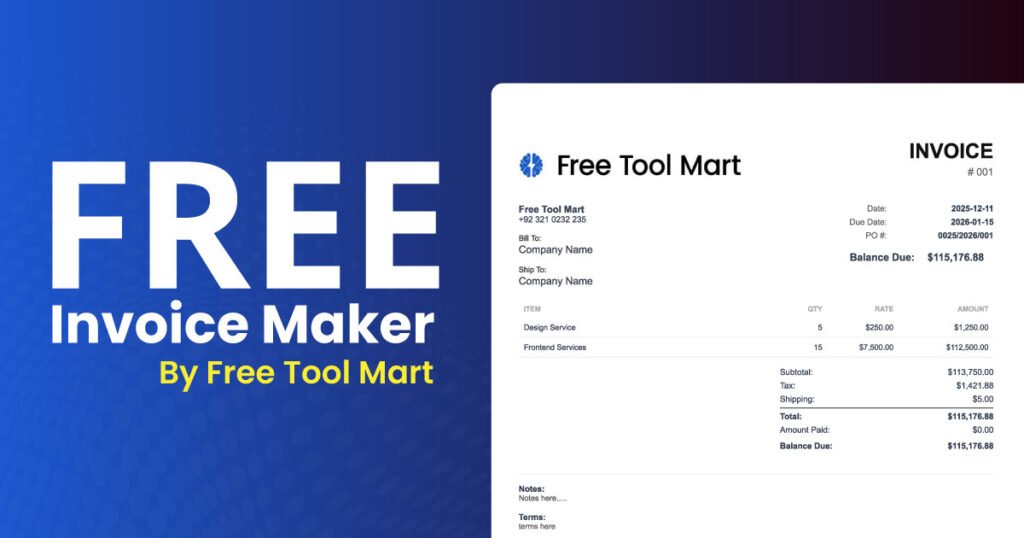

How Online Invoice Tools Help Small Businesses

Manual invoicing is time-consuming and error-prone. Online invoice tools simplify the process by automating calculations and formatting.

Benefits include:

- Faster invoice creation

- Automatic totals

- Professional layouts

- Reduced human error

Small businesses can use a dedicated Invoice Generator to create professional invoices quickly and avoid calculation mistakes.

(Add your internal link here.)

When an Invoice Generator May Not Be Enough

Invoice generators work well for most small businesses, but not every scenario.

Additional tools may be required if:

- Complex tax structures are involved

- Large invoice volumes exist

- Multiple currencies are used

- Advanced reporting is required

In such cases, accounting software or professional advice may be necessary.

Best Practices for Professional Invoicing

To maintain consistency:

- Use a standard invoice format

- Send invoices promptly

- Store digital copies

- Follow up politely on overdue payments

Good invoicing habits support long-term financial stability.

How Invoicing Practices Change as a Small Business Grows

Invoicing needs evolve as a business grows. What works for a solo freelancer may not be suitable once the business gains more clients or expands services. Small businesses should regularly adjust invoicing practices to match their scale and complexity.

As transaction volume increases, consistent invoice numbering and standardized formats become critical. Payment terms may need tightening, and follow-up processes may need to be formalized. Businesses offering multiple services may also need clearer service categorization to avoid confusion.

Understanding how small businesses create invoices at different growth stages helps owners stay organized, maintain professionalism, and prevent invoicing problems before they impact cash flow.

Final Thoughts

Learning how small businesses create invoices correctly is essential for maintaining healthy cash flow and professional credibility. Clear invoices reduce disputes, improve payment timelines, and simplify financial management.

By following a structured invoicing process and using reliable tools, small businesses can focus less on chasing payments and more on growing their operations.